Assets of the company representing the amount owed by customers. Accounts Receivable Manager Job summary 2.

What Are Accounts Receivable Bdc Ca

Skills For Officer Accounts Receivable With Italian Resume.

. The Accounts Receivable Manager is an integral member of the finance team and leads the credit and collection activities. This money is typically collected after a few weeks and is recorded as an asset on your companys balance sheet. Accounts Receivable Analysts average about 2169 an hour which makes the Accounts Receivable Analyst annual salary 45124.

Batching and banking of cheques. All but one of the following are required before a transfer of accounts receivable can be recorded as a sale. Accounts receivable is any amount of money your customers owe you for goods or services they purchased from you in the past.

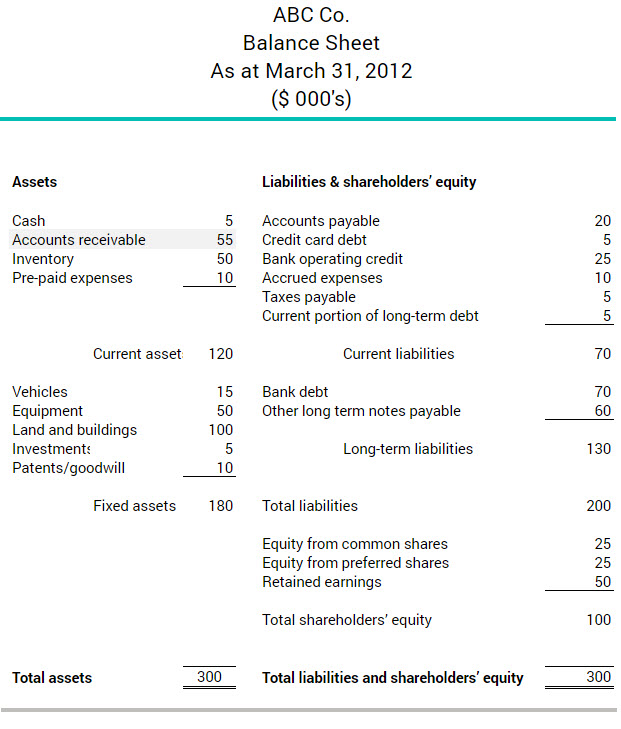

Enough information should be disclosed in the financial statements so a person wishing to invest in the stock of the company can make a profitable decision. Liabilities of the company that represent the amount owed to suppliers. Actioning contact with debtors to arrange payment of outstanding invoices.

Accounts Receivable Reconciliation with QuickBooks If youre using QuickBooks this process is much simpler than if you were performing a manual reconciliation. Definition and explanation. It differs from an assignment in that a company actually transfers ownership of the accounts receivable to the.

Amounts that have previously been received from customers. Sale of ABCs accounts receivable to XYZ with the risk of uncollectible accounts retained by ABC d. What that adjustment looks like is what will be described below as there are different ways and different methods.

Updating database with new credit terms. Cash net realizable value. Amounts that have previously been received from customers.

Sale of Gars accounts receivable to Ross with the risk of uncollectible accounts retained by Gar. An account receivable is documented through an invoice which the seller is responsible for issuing to the customer through a billing procedure. Select one or more.

The balance in accounts receivable at. On average the Accounts Receivable Manager annual salary is 66625 per year which translates to 3203 an hour. This means that the top-earning Accounts Receivable Analysts make 17000 more than the lowest earning ones.

The bottom line is an accounts receivable adjustment is a debit or a credit applied to the amount a customer owes. The AR Manager assists in protecting the financial assets of the company within accounts receivable. The invoice describes the goods or services that have been sold to the customer the amount it owes the seller including sales taxes and freight charges and when it is supposed to pay.

How to write off bad debt expense in accounts receivable. The institution to whom receivables are sold is known as factor. Loan from XYZ collaterized by ABCs accounts receivable b.

Sale of the accounts receivable to the bank with risk of uncollectible accounts retained by the entity. The entity received cash as a result of this transaction which is best described as. Accounts and notes receivable are reported in the current assets section of the balance sheet at.

On most company balance sheets accounts. You use accounts receivable as part of accrual basis accounting. Loan from XYZ to be repaid by the proceeds from ABCs account receivable c.

Generally speaking Accounts Receivable Managers earn anywhere from 49000 to 90000 a year which means that the top-earning Accounts Receivable Managers make 41000 more than the ones at the lower end of the spectrum. Receipting of payments received ensuring any discrepancies are investigated and resolved. Bank loan collateralized by the accounts receivable.

Factoring accounts receivable means selling receivables both accounts receivable and notes receivable to a financial institution at a discount. Factoring is a common practice among small companies. Liabilities of the company that represent the amount owed to suppliers.

Amounts that have previously been received from customers c. Accounts receivable AR is the balance of money due to a firm for goods or services delivered or used but not yet paid for by customers. Accounts receivable is an asset as it both represents the amount owed by the customer to a business and is convertible to cash at a future time.

Loan from Ross collateralized by Gars accounts receivable. The transferor maintains continuing involvement. Accounts receivable are best described as.

ABC received cash as a result of this transaction which is best described as a. QuickBooks reconciliation feature allows you to make edits to existing transactions and create new ones to ensure the numbers are correct in your reconciliation report. Loan from Ross to be repaid by the proceeds from Gars accounts receivable.

Assets of the company representing the amount owed by customers. Up to 25 cash back Cash accounts receivable inventories prepaid items. Gar received cash as a result of this transaction which is best described as a.

When an entity factored accounts receivable without recourse with a bank the transaction is best described as a. An entity factored accounts receivable without recourse with a bank. Which of the following best describes accounts receivable.

Apollo Company had net credit sales during the year of 800000 and cost of goods sold of 500000. Amounts that have previously been paid to suppliers. Amounts that have previously been paid to suppliers.

The full disclosure principle as adopted by the accounting profession is best described by which of the following. Accounts receivable are best described as a. Liabilities of the company that represent the amount owed to suppliers b.

Assets of the company representing the amount owed by customers d. What is an accounts receivable adjustment. Insurance Expense would appear on which of the following financial statements.

A sale of accounts receivable to a factor ie bank financial institution on a without recourse notification basis. Accounts receivable are best described as. Bank loan to be repaid by the proceeds from the accounts receivable c.

Additionally Accounts Receivable Analysts are known to earn anywhere from 37000 to 54000 a year.

What Is Accounts Receivables Examples Process Importance Tally Solutions

0 Comments